Hello.

Sorry for my English level, it´s not good.

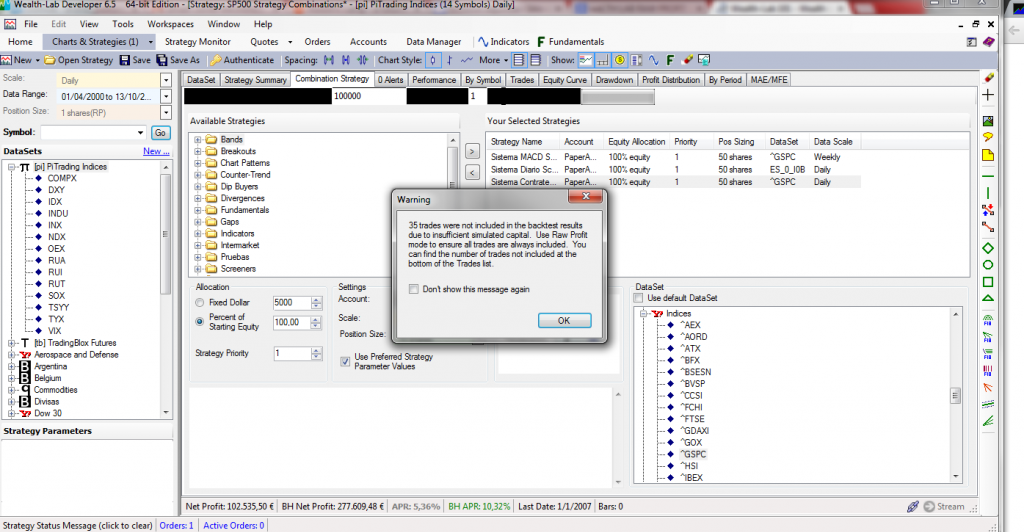

I use WL 6.5.20 and I have the next problem than I can´t understand.

I backtest 3 different strategies on ES e-mini SP500. So as e-mini S&P500 futures point is 50USD, I configure position size as 50 contracts. If I dont´configure like this, the profit is 1USD for each point.

When I did backtesting WL said me than 35 trade didn´t execute for insufficiente capital. it´s OK, because in moments when the 3 system are in market with 50 contracts each one with 1USD point for contract, i some moments portfolio don´t have enought capital. It´s OK:

Problem appears when I want configure than a e-mini contract don´t requieres about 1700USD, I understand it can be done with margin factor. I checked to use booth margin factors: the first, of the portfolio than appears right side to starting capital, and the second than appears on each position size for each system, but don´t appears to have effect.

How can I make than requiered warranties will be 5% of contract value?

Could anybody help me?

Thanks.

Regards.

Size:

Color:

In Combination strategies, margin is applied to

allocation, not the sizing control. Quoting from the User Guide:

QUOTE:

Combination Strategy margin affects allocation. For example, with 2:1 margin you can allocate up to 200% of Starting Capital to a child strategy. Assuming $100,000 Starting Capital with 200% allocation, it follows that 100% of equity sizing will size a $200,000 position.

Just to be on the safe side, are you aware that to correctly set up Wealth-Lab for futures, you must use the Symbol Info Manager tool? See the User Guide > Reference > Symbol Info Manager.

Size:

Color:

Thanks Eugene :)

Size:

Color:

QUOTE:

If I dont´configure like this, the profit is 1USD for each point.

Specifically, use the Symbol Info Manager to ensure that Futures Mode is enabled, and, enter one or more records for your contract symbol(s). You can match multiple symbols with one entry (see User Guide: Reference > Symbol Info Manager > Fields / Properties > Symbol).

The point value for your contract is 50. Futures margin depends on your broker, but will be on the order of $3500 for an S&P 500 e-mini. Generally, you'd leave account margin at 1:1 for trading futures, but it depends on how you want to simulate your broker's calculation of account liquidity.

Size:

Color:

Thanks Cone.

What´s the data provider where the symbol info than you create its supported?

If I create a symbol ES[HMUZ]\d as user guide says, ¿what data provider will gives to WL that information? ¿Will WL search in all data providers for ES symbols?

I don´t understand well how symbol info manager works with the user guide information

Regards.

Size:

Color:

QUOTE:

What´s the data provider where the symbol info than you create its supported?

It's a global Wealth-Lab feature, meaning that all data providers automatically "support" the symbol information entered in the Symbol Info Mgr box. Wealth-Lab will apply the setting to all symbols satisfying that "ES[HMUZ]\d" pattern (for example) across all installed data providers.

Size:

Color:

Thanks for your help Eugene.

Do you know any data provider than gives e-mini SP500 futures free EOD?

I don´t found it in Bloomberg, and I usually uses PiTranding Futures, but that provider only gives continuous contract future, so is not valid.

Thanks!

Size:

Color:

No idea about the free data but IQFeed should definitely have the S&P Eminis, both continuous and individual contracts, EOD and intraday.

Size:

Color: